Read time: 5 minutes 49 seconds.

Are you accidentally stifling the potential growth of your influencer program?

Eleni from Modash here with another issue of Return on Influence, the influencer marketing newsletter where over 50% of readers say they get a useful, actionable tip from each issue.

(You can vote at the bottom of this email!)

Today, I want to talk about a common mistake I see marketers make. The one where they get stuck only working with influencers in their product category.

Don’t get me wrong, this focus on product category is a smart way to start looking for influencers for many brands. But eventually, you run out of influencers or a captive audience.

The audience over it

For some brands, this product-focused approach might never work. You’re not going to find many — if any — lamp influencers, rug influencers, candle influencers, or puzzle influencers.

So, how do you find and test influencers outside your product category?

That’s what I’m sharing in this issue of ROI 👇

Tip #1: Focus on your ideal buyer too

There are two lines of thinking you can take with influencer selection.

Neither is incorrect, but one limits your pool of potential influencers while the other expands the pool.

Here’s an example:

Focus on product category ⬇️ I have a beauty product, so I must work with beauty influencers. ⬇️ LIMITS | Focus on your ideal buyer ⬇️ My ideal buyers are women aged 35-45. Who reaches those people online? ⬇️ EXPANDS |

Looking for influencers within your product category limits your pool of influencers to “obvious” creators. They’re the ones who have probably worked with your competitors and, as a group, attract a similar audience.

On the other hand, looking for influencers with your ideal buyer in mind automatically widens the pool to include all types of creators. The audience grows, and your competitors likely won’t know they exist.

Take this example —

Imagine you’re responsible for influencer marketing at Frankies Bikinis. You can think about influencer selection like this.

Focus on product category “I sell bikinis, so I need to work with bikini influencers. “ | Focus on ideal buyers “My ideal buyers are women aged 21- 45 who shop luxury. Who reaches those people online?” |

If you stick to your product category, you’re more likely to look for and approach bikini models, right?

But if you consider who your ideal buyers follow online, you could end up working with a home cook who creates a recipe based on the aesthetic of your new Spring collection👇

@jennys__table Whipped ricotta, nectarines and honey for @frankiesbikinis new spring collection🦋🌼🍑 #ad soft textures, delicate details and bright tones. ... See more

Not only is this collab unexpected, but Frankies Bikinis have introduced themsevles to a new audience that may never have discovered them.

When I pop this creator into Modash, we see that her audience is exactly in line with Frankie Bikinis ideal buyer (90% women, with the majority in the right age group.)

But do these “out of the box” partnerships work?

When Rugile Paleviciute (now Head of Partnerships at Burga) promoted a health & fitness app, fitness influencers were not the brands’ top performers.

A gardening creator was.

“Our target audience was women in a specific location, aged 35-45. I thought about what other hobbies those people would have and tested influencers in gardening, knitting, flower pressing, etc.

Sometimes, your best creators will be based on your product category. Other times, you might have to go deeper to find your best-performing niche.

At the very least, focusing on your ideal buyers may help you find a second-best or third-best niche.

And that’s how you keep growing.

🤓To see more examples of unexpected high-performing partnerships, check out How To Identify & Test New Niches For Your Influencer Program.

Tip #2: Find non-obvious niches to test

Okay, Eleni, you might be saying. I get it. But how do I find these non-obvious niches? How do I think outside the box?

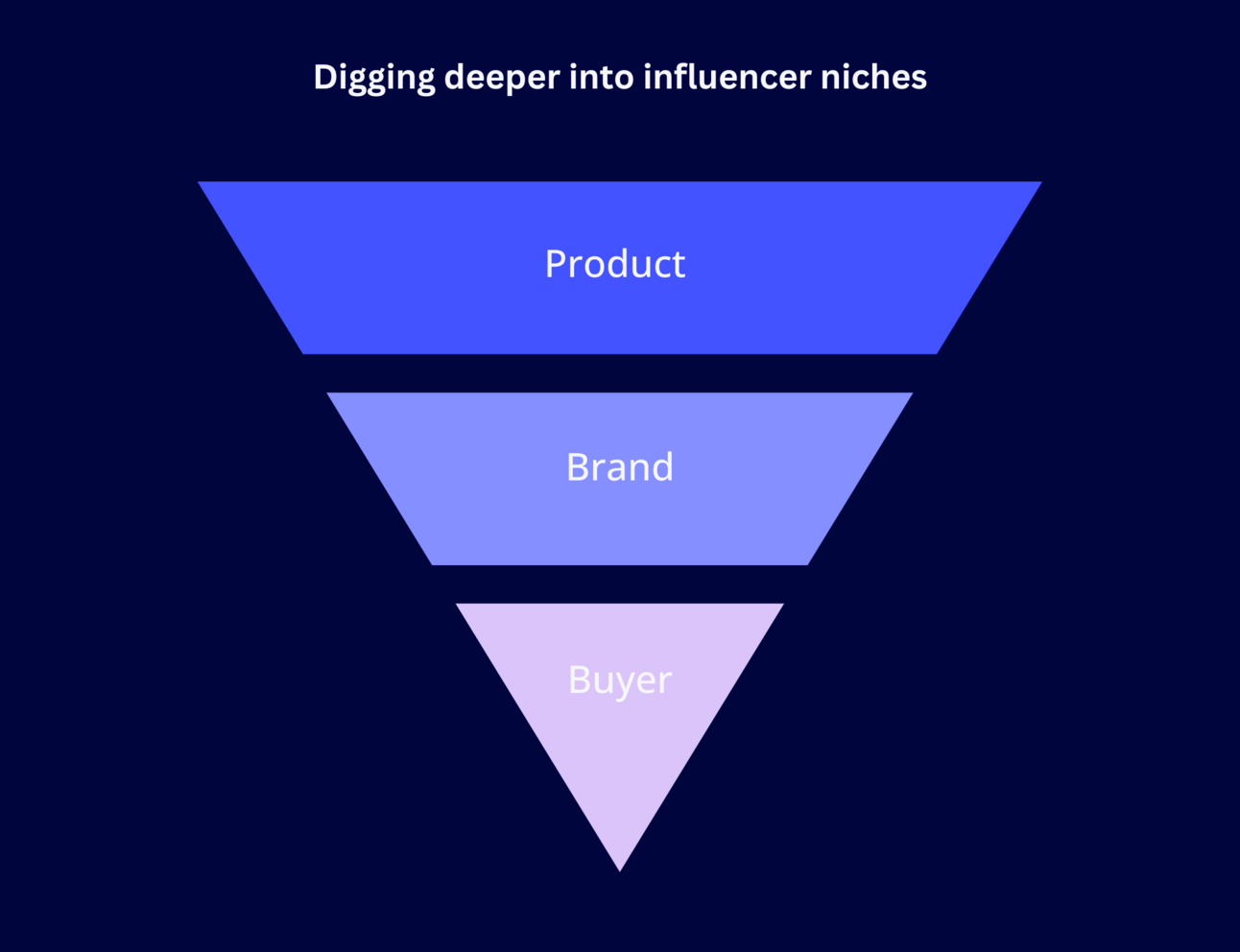

Easy, turn the box into an inverted triangle.

As I said, a lot of marketers get stuck on the product they’re selling, i.e., lamps, candles, fitness apps.

If you think deeper into your brand and buyer, you’ll find less obvious niches that could work well for you.

Start by picturing your ideal buyer. Then, think about your ideal buyer’s life from different angles and document the keywords.

You don’t need to spend time or money to do this. Instead, take an hour or two to brainstorm like this 👇

Product benefits

What benefits does your product provide, and who needs those benefits?

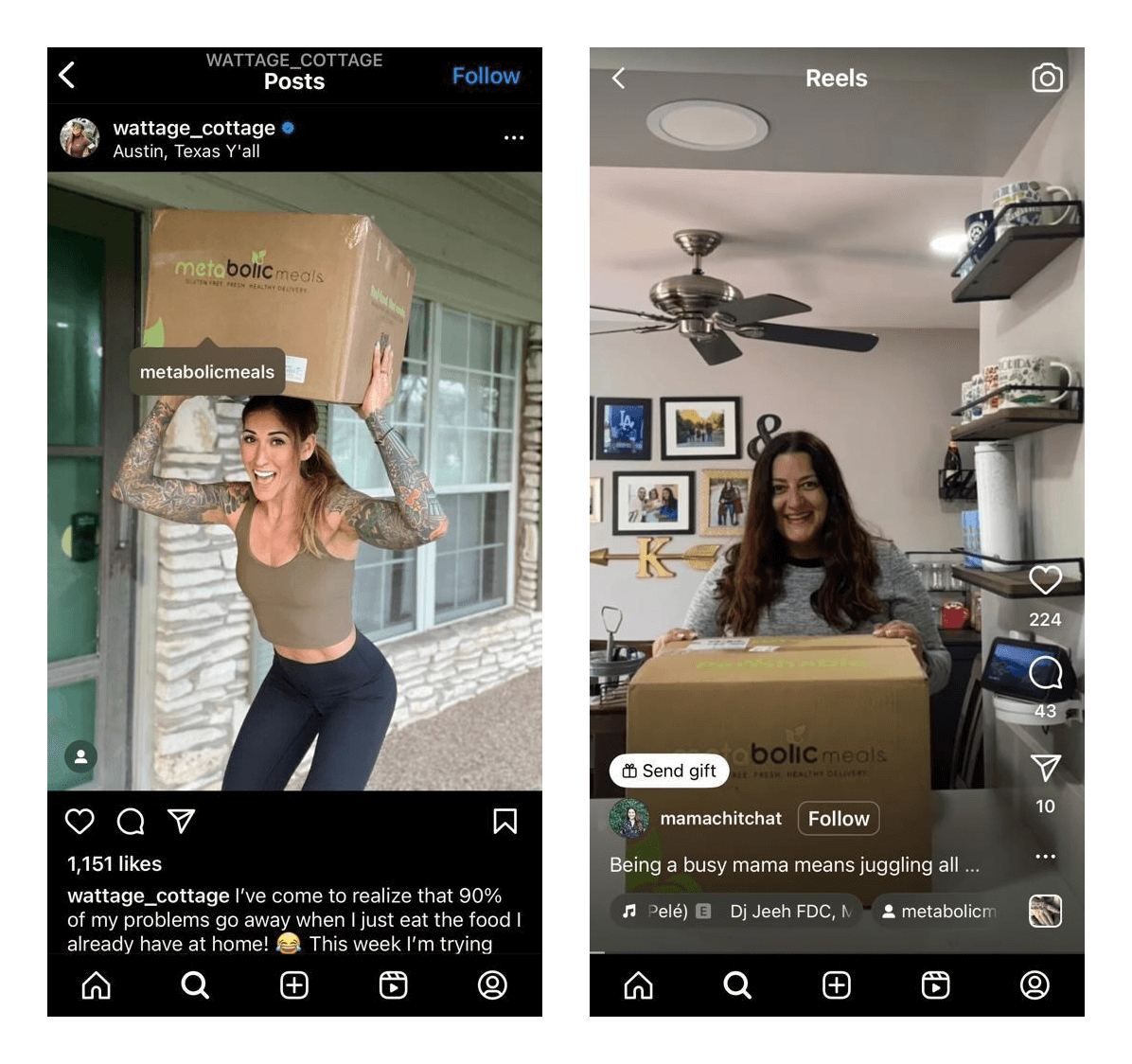

Take Metabolic Meals for instance. They sell healthy pre-prepped meals that save you time and keep you healthy. Health & fitness enthusiasts are the obvious group.

But moms are another — busy moms who don’t have time to cook something healthy and delicious for their kids. When Metabolic Meals realized this, they started partnering with moms to reach another audience.

Brand values

Do you have important brand values? You can find creators that share these values and reach your target audience.

For example, Wild (a refillable deodorant brand) recruits around 200 new influencers every month, and “sustainability influencers” are one of their top-performing niches.

Audience life stage

Is your ideal buyer in a specific life stage? Some life milestones can trigger the need/want for some products. Are they single? Pregnant? Just bought a house?

Use these “identities” to look for creators.

Let’s say you sell furniture. People who have recently moved house are likely a great segment. You could look for influencers who create content around buying a house (e.g., search hashtags like #moving or #homeowner).

Audience hobbies

What else is your ideal buyer likely interested in besides your product category? A brand selling puzzles will run out of “puzzle influencers” very quickly.

Think about what else your buyer likes doing. Chess? Fishing? Horror movies? Gaming?

Hobbies will be easy to translate into influencer searches. Using hashtags, you can search for the hobby (e.g., search "#fishing #angler and find new types of influencers in these non-obvious niches.

🤓 Learn more about how to set up guardrails as you brainstorm new niches

Tip #3: Manage expectations around testing

Not all of these non-obvious niches or influencers will work. You’ll need to test influencers to find the ones that do.

(I wrote more about trialing new influencers in this issue.)

Typically, we see that the most successful influencer marketers run at least two different programs simultaneously.

Test - These are niches (and influencers) you’re unsure about because they haven’t been tested yet.

Trust - These niches (and influencers) have been tested and performed well. They can also be considered as safe bets.

If you’re starting, you might not have any “safe” bet niches yet, but you can replace them with “less risky” bets. E.g., sticking with the most obvious influencer categories.

Fiona Macpherson, who leads a team of influencer marketers at Wild, told us that you have to set the right expectations with leadership around testing.

“Some influencer collaborations won’t achieve the expected outcome, and that’s okay. Leadership should expect that, and while the team should be diligent, they shouldn’t be terrified of failure.”

Explain to your leaders that your program will always take a testing approach and report on successes, failures, and learnings.

But you don’t want to make this mistake when testing. Don’t give up on an entire niche by only testing 1-2 influencers. Activations might not work for various reasons other than the influencer niche.

Keep testing! Being in the trenches doing this every day will fine-tune your gut feeling.

What’s everyone else doing?

How much of your influencer budget should go to testing niches vs. safe bets?

Test vs. trust niches

Dmitri Cherner (prev. Head of Influencer at Ruggable, OneSkin) recommends adapting your split based on program maturity:

Start with 70% testing / 30% safer bets while launching a program.

Move to 30% testing / 70% safer bets later once you’ve established your best niches.

Your split will depend on your budget and your company's culture of testing and risk-taking. We’ve also seen teams split programs into 80% safer bets and 20% testing.

Thanks for reading!

Until next time,

Eleni Zoe

Product Marketing @ Modash, Newsletter writer, Person who has to water her plants

Will you use any of these tips in your work?

Was this forwarded to you by a friend or colleague?

You can subscribe in one click with this link